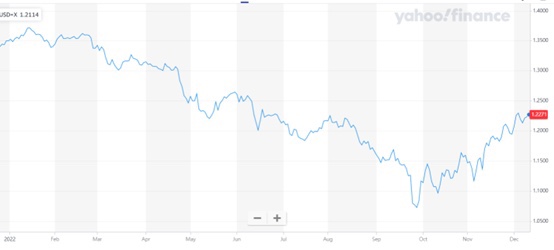

The pound spent its 2022 years on a roller coaster. The pound fluctuated against the dollar until April but stayed above 1.3. Since April 22, the pound has been on a downward spiral. Britain’s tax cuts in September also had a strong impact on the pound, which fell 8 percent in a month. On September 28, 2022, the pound fell to a record low of 1.07 against the dollar. So far this year, the pound has fallen 17 percent against the dollar to a 37-year low. Meanwhile, inflation is at a 40-year high, consumer confidence is tumbling and the energy crisis is worsening. Britain’s economy is going through its winter.

Although the UK economy has brought a lot of bad feelings to all sides, I as an international student who did not come to the UK territory, have benefited from it. First, the value of RMB has fluctuated in the past year, but it is stable compared to other currencies in the world. Therefore, influenced by the depreciation of the British pound, the exchange rate of RMB against the British pound has been continuously falling. This situation allows me to exchange the same amount of RMB for more pounds than before, which gives me an invisible discount when I pay the tuition. Secondly, I didn’t come to the UK, so I avoided the high prices of electricity and gas in the UK today. In my study abroad life, I enjoyed the exchange discount and avoided the high living expenses in the past, which made my study abroad have a very high-cost performance.

GBP continued its upward trend after September 28 and reached its subsequent small peak on November 5 (GBPUSD=1.2297). The increase surprised many analysts and had pros or cons effects on many multinational companies. Now I would like to share my thoughts on this issue from the perspective of China-UK trade.

Let’s start with an example of purchasing: a Louis Vuitton shopping bag costs £795 in the UK. The price started at 6,598 yuan on the 23rd but fell to 5,713 yuan a few days later, a gap of 885 yuan. Similarly, many of China’s big cross-border export e-commerce groups are facing shrinking profits, many companies adjust their prices, which will inevitably lead to a decline in sales, and the value creation of cross-border export companies will be more difficult than ever. This reminds me of the main objectives of corporate finance that I learned in university. It is divided into five main aspects. In the current situation, if the company wants to continue to maintain value creation, it should also change its financial objectives. To avoid the further expansion of adverse effects, the financial decisions of these companies should be transferred from profit maximization to survival. In essence, these companies suffering from exchange rate losses should make sustainable financial decisions that are consistent with the current situation.

The company wants to continue to ensure the growth of its revenue in the current environment. It is very difficult to obtain a return rate no lower than that in the past. I think we can refer to the concept of value action pentagon for planning. Therefore, the required rate of return can be appropriately reduced in financial planning. In addition, efforts should be made to increase the return on existing capital. For example, to lay out their brands or participate in the holding of logistics companies. This will not only save the cost of these aspects as much as possible but also obtain additional investment income. Finally, after experiencing this crisis, the company should expand its vision of planning. They can expand their business scope and diversify the risks that their company may face. For example, foreign trade companies that mainly trade with the United Kingdom can expand their business in North America or other Asian countries to achieve risk hedging.